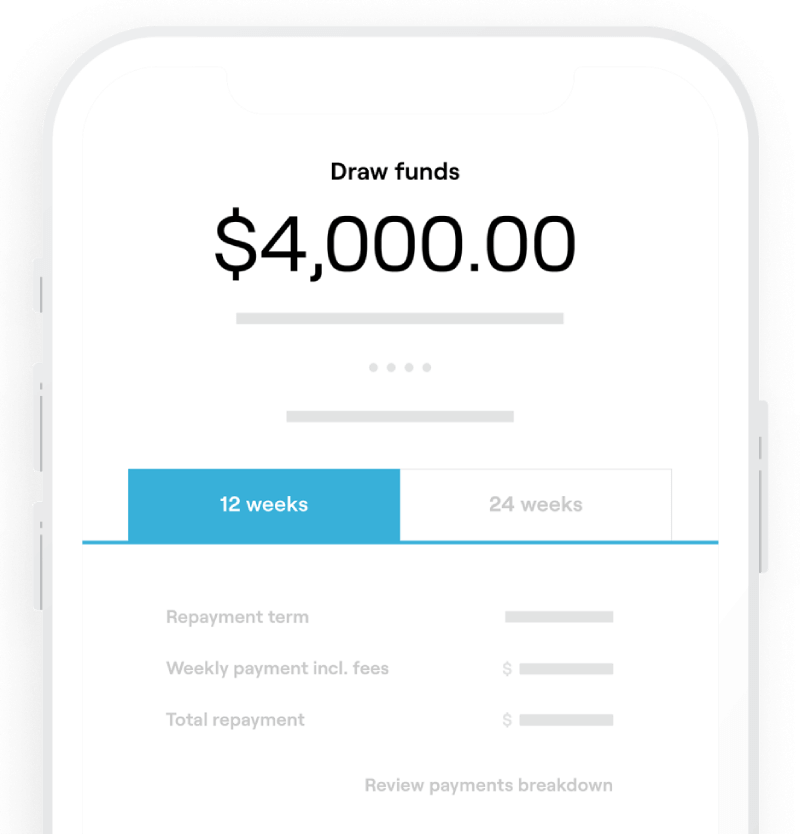

Businesses can now access working capital from Fundbox through Stripe

Fundbox and Stripe have joined forces to provide businesses with even more access to working capital through Stripe Apps. Stripe customers can now access a Fundbox Line of Credit directly from their Stripe dashboard.