The Paycheck Protection Program (PPP) is designed to help small businesses and independent contractors who have been negatively impacted by the coronavirus pandemic. The PPP can provide 1% interest loans that are potentially forgivable if borrowers use the money according to the program rules. As of December 27, 2020, Congress has approved additional funds for the PPP until May 31, 2021, or until funds run out. Fundbox is no longer accepting PPP applications, however, the SBA can help you find a PPP lender.

While the PPP promised a streamlined, low-documentation process, some business owners may still face confusion over what they need to provide their prospective lender. These include payroll calculations and supporting documents. To help maximize your success, we have prepared a list of possible documents that you may want to have at your fingertips when it’s time to apply to your lender. Please note that specific requirements and acceptable documents may vary depending on the lender.

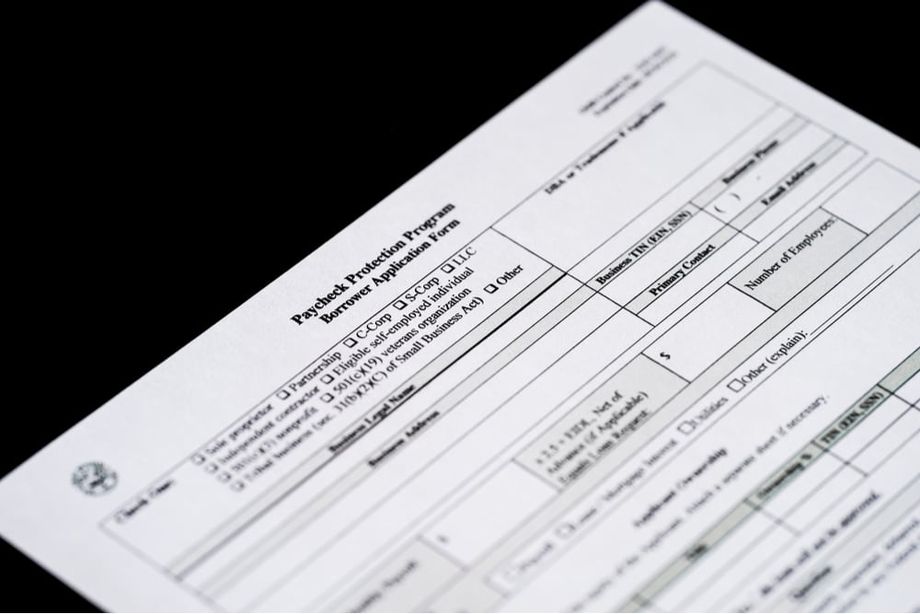

1. Completed PPP application form

- Download and complete the SBA PPP application, Form 2483 (or 2483 SD), from the SBA website. There is one application form for first-time PPP loans and a different form for second draw PPP loans. Make sure you have the most current version (bottom-dated 01/21). The older form, dated 03/20, includes now irrelevant questions about citizenship status.

- Include your contact name and email address.

- List the names of all owners (over 20%).

- Indicate your Business Type (Independent Contractors and Sole Proprietors have slightly different document requirements.

Check Yes or No for all questions on the form.

- If you answer Yes to questions 1,2, 5, or 6, you do not qualify for a PPP loan.

- If you answer Yes to question 3 or 4, you may still qualify, but you must include an Addendum on a separate sheet explaining the details.

2. Proof of payroll or income

Document types required for a PPP application depend on the type of company—whether you have employees, are an independent contractor, are a partnership, or are a non-profit. While your specific lender’s requests may vary, here are the generally required documents for most businesses as indicated:

For independent contractors/sole proprietors/self-employed without employees:

- 2019 or 2020 IRS Form 1040 Schedule C. (If you are using 2020 to calculate the loan amount but you haven’t filed your 2020 taxes yet, you may provide a draft.)

- If you are including an Economic Injury Disaster Loan (EIDL) that was taken from 1/31/20-4/3/20, provide a bank statement showing the deposit into your business account.

- Invoice, bank statement, book of record, or a 1099 MISC that covered the period up to 2/15/2020.

For sole proprietors/self-employed with employees:

- Payroll/health insurance/retirement benefits for employees: 2019 or 2020 IRS 1040 Schedule C.

- Form 940 or four quarterly Form 941s.

- State quarterly wage unemployment insurance tax reporting forms for each quarter.

- If you are including an Economic Injury Disaster Loan (EIDL) that was taken from 1/31/20-4/3/20, provide a bank statement showing the deposit into your business account.

- Invoice, bank statement, book of record, or a 1099 MISC that covered the period up to 2/15/2020.

For corporations (& LLCs that file as corporations):

- For owner’s income: a 2019 or 2020 IRS Form 1040 Schedule C. (If you are using 2020 to calculate the loan amount but you haven’t filed your 2020 taxes yet, you may provide a draft.)

- Form 940 or four quarterly Form 941s.

- Form 1120 or Form 1120-S tax return to substantiate health insurance or retirement benefits to employees.

- If you are including an Economic Injury Disaster Loan (EIDL) that was taken from 1/31/20-4/3/20, provide a bank statement showing the deposit into your business account.

- Invoice, bank statement, book of record, or a 1099 MISC that covered the period up to 2/15/2020.

- Quarterly state wage unemployment insurance tax reporting forms (for each quarter).

For partnerships (& LLCs that file as partnerships):

- 2019 or 2020 IRS Form 940 or four quarterly Form 941s.

- 1065 tax return (including K1’s) to substantiate health insurance or retirement benefits to employees, and self-employment earnings for the partners.

- State quarterly wage unemployment insurance tax reporting forms for each quarter.

- Invoice, bank statement, book of record, or a 1099 MISC that covers the period 2/15/20.

For non-profits:

- 2019 or 2020 IRS Form 940 or four quarterly Form 941s.

- Form 990 showing health insurance and/or retirement plan benefits to employees.

- State quarterly wage unemployment insurance tax reporting forms for each quarter

- Parsonage report (if applicable)

3. Unexpired, government-issued driver’s license or passport (for all owners over 20%)

Each owner must be accounted for in the PPP application form and require a copy of a government-issued photo ID such as a state-issued driver’s license or passport.

4. Voided check

So the lender can deposit approved funds into your account, you may be asked to provide a voided check. Some lenders (but not all) may accept electronic funds transfer information by other means.

5. Documents needed for proof of 25% revenue reduction (for a second draw PPP)

If you’ve received and exhausted a previous first-time PPP loan, you may now qualify for a second draw PPP. In addition to the documents listed above, you will need one of the following (your choice) to demonstrate your revenue reduction:

- 2019 and 2020 tax forms (IRS Form 1040 Schedule Cs).

- 2019 and 2020 quarterly income statements (for the same quarter for 2019 and 2020)

- If the business started between 1/1/2020-2/15/2020, quarterly income statements or bank statements for Q2, Q3, or Q4 compared to Q1.

- 2019 and 2020 bank statements (for the same quarter for 2019 and 2020).

Learn more details

For more information on the PPP loan, please visit the U.S. Chamber of Commerce’s website.

Disclaimer: This information has been aggregated from external sources. Fundbox and its affiliates do not provide financial, legal or accounting advice. This content has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for financial, legal or accounting advice. You should consult your own financial, legal or accounting advisors before engaging in any transaction.